3 Graphs Showing Why Today's Las Vegas Housing Market Isn't Like 2008

3 Graphs Showing Why Today's Las Vegas Housing Market Isn't Like 2008

Here are 3 Graphs Showing Why Today's Las Vegas Housing Market Isn't Like 2008. You may have heard all the talk in the media about the housing market shift, but you might be wondering if this is a housing bubble. You might have also asked whether this is a replay of the 2008 housing crisis. Fortunately, factual data supports why this won't be the case.

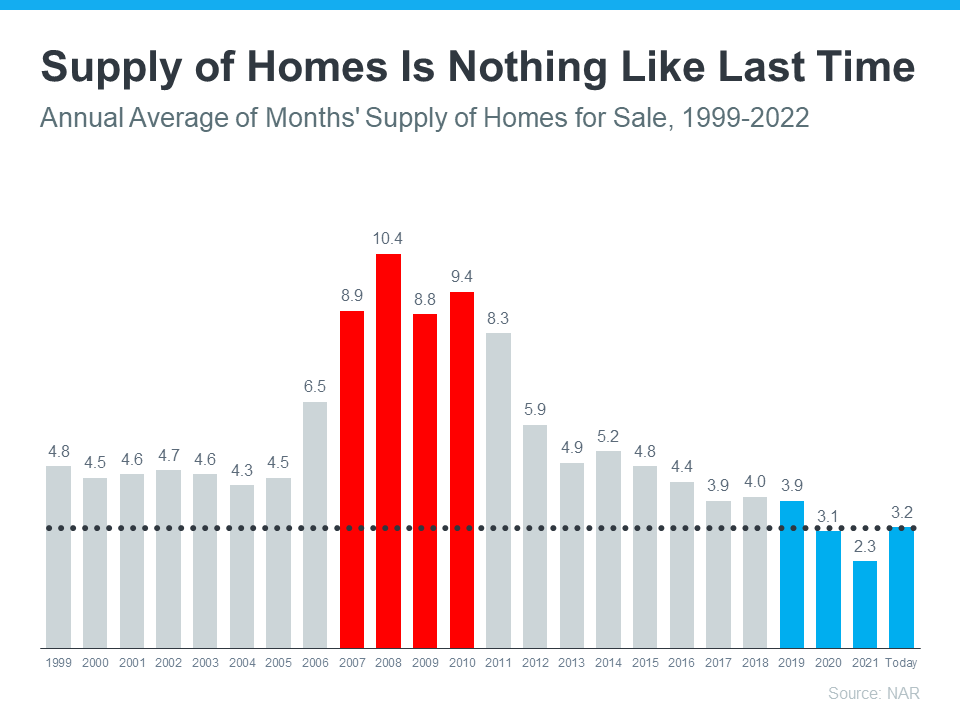

There's Still a Shortage of Homes on the Market Today, Not a Surplus

For historical context, there were too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Supply has increased since the start of this year, but there's still a shortage of inventory, primarily due to almost 15 years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) to show how the months' supply of homes available now compares to the crash. Today, unsold inventory sits at just a 3.2-months supply at the current sales pace, which is significantly lower than the last time. There isn't enough inventory on the market for home prices to come crashing down like last time, even though some overheated markets may experience slight declines.

Southern Nevada had a 4.0-month inventory of houses in September 2022, up from a 1.1-month supply last September. It is a good indicator of whether a particular real estate market favors buyers or sellers if the months of supply are high. A seller's market typically has less than six months' worth of homes for sale, while an excess of homes signifies that buyers are favored in markets with more than six months' worth of inventory.

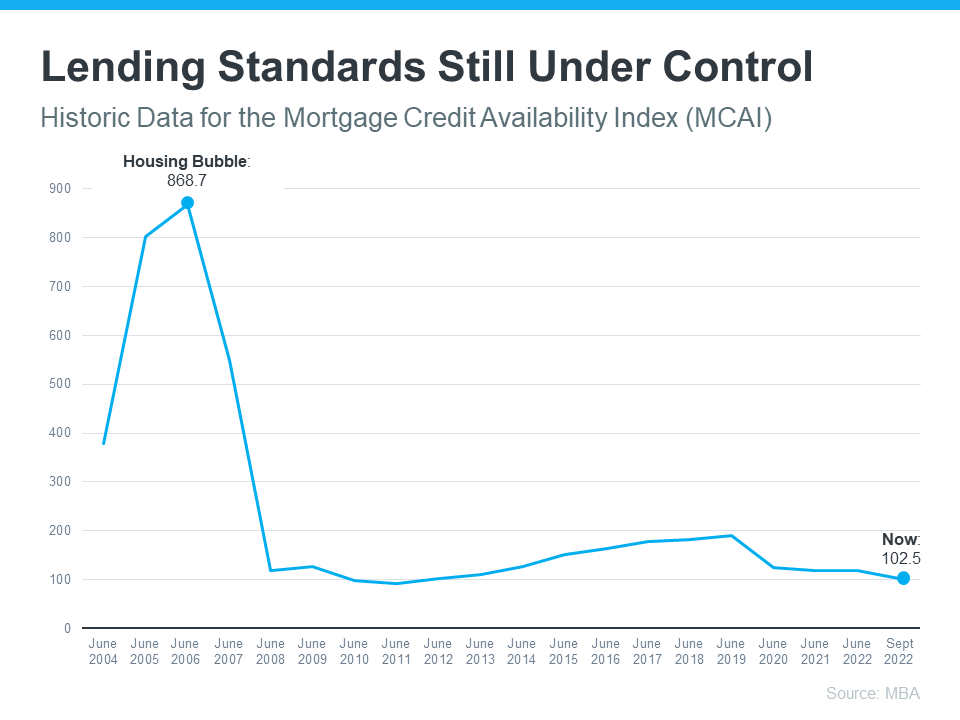

Mortgage Standards Were Much More Relaxed Back Then

It was much easier to get a home loan during the lead-up to the housing crisis than today. Then, running up to 2006, banks were creating artificial demand by lowering lending standards and making it easy for anyone to qualify for a home loan or refinance their current home.

Back then, lending institutions took on much more significant risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices. Today, things are different, and purchasers face much higher standards from mortgage companies.

The graph below uses Mortgage Credit Availability Index (MCAI) data from the Mortgage Bankers Association (MBA) to help tell this story. In that index, the higher the number, the easier it is to get a mortgage. Conversely, the lower the number, the harder it is. In the latest report, the index fell by 5.4%, indicating standards are tightening.

The graph illustrates how things have changed since the credit boom of the early 2000s. As the last time, over the past fourteen years, tighter lending standards have prevented a scenario in which there would be a wave of foreclosures.

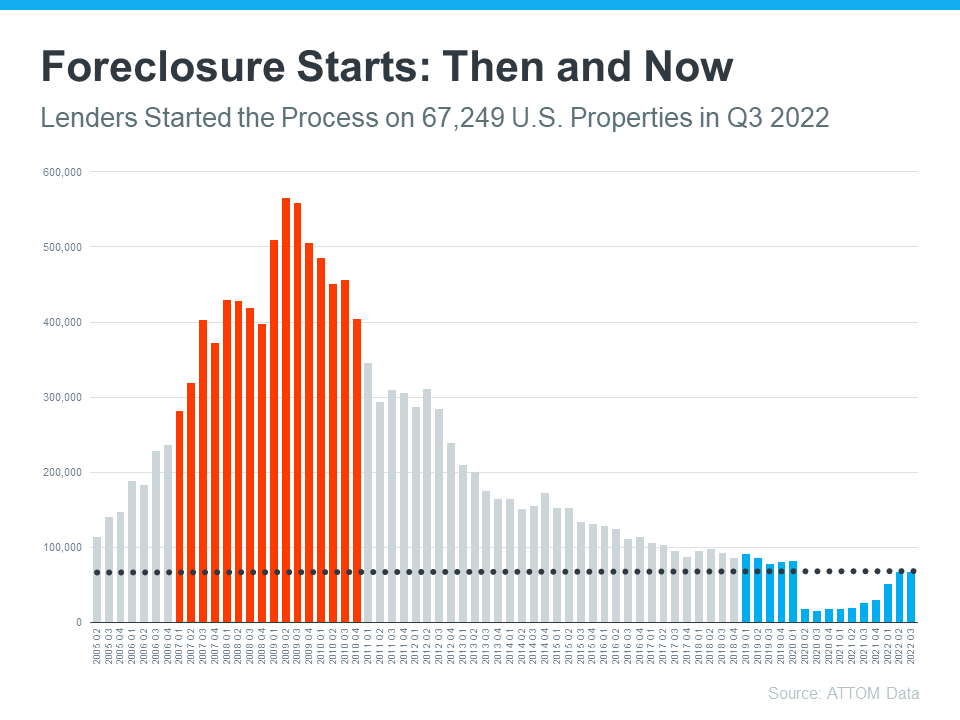

The Foreclosure Volume Is Nothing Like It Was During the Crash

Another difference is the number of homeowners facing foreclosure after the housing bubble burst. However, foreclosure activity has been lower since the crash, mainly because buyers today are more qualified and less likely to default on their loans. The graph below uses data from ATTOM Data Solutions to help paint the picture of how different things are this time:

Not to mention, homeowners today have options they didn't have in the housing crisis when so many people owed more on their mortgages than their homes were worth. Today, many homeowners are equity rich. That equity comes, in large part, from the way home prices have appreciated over time. According to CoreLogic:

“The total average equity per borrower has now reached almost $300,000, the highest in the data series.”

Rick Sharga, Executive VP of Market Intelligence at ATTOM Data, explains the impact this has:

“Very few of the properties entering the foreclosure process have reverted to the lender at the end of the foreclosure. . . . We believe that this may be an indication that borrowers are leveraging their equity and selling their homes rather than risking the loss of their equity in a foreclosure auction.”

This goes to show homeowners are in a completely different position this time. For those facing challenges today, many have the option to use their equity to sell their house and avoid the foreclosure process.

According to Las Vegas Realtors spokesperson George McCabe, the association's data shows that foreclosures remain historically low. According to the association's report, short sales and foreclosures combined accounted for 0.1% of all existing local property sales in September. That compares to 0.4% one year ago, 1.0% of all sales two years ago, 2.0% of all sales three years ago, 2.5% four years ago, and 5.2% five years ago. In addition, in the third quarter of this year, 1,094 of the 917,656 housing units (0.12%) in the Las Vegas valley had a foreclosure filing, up 17% from the previous quarter and 42% from a year ago.

Bottom Line

If you're concerned, we are remaking the same mistakes that led to the housing crash; the graphs above should help alleviate your fears. Factual data and expert insights clearly show this is nothing like the last.

Comments

Post a Comment